Mortgage Rates Are Finally Falling: See How Much Homebuyers Can Save on a House Right Now

- RAW Developments

- Feb 13, 2024

- 3 min read

By: Evan Wyloge

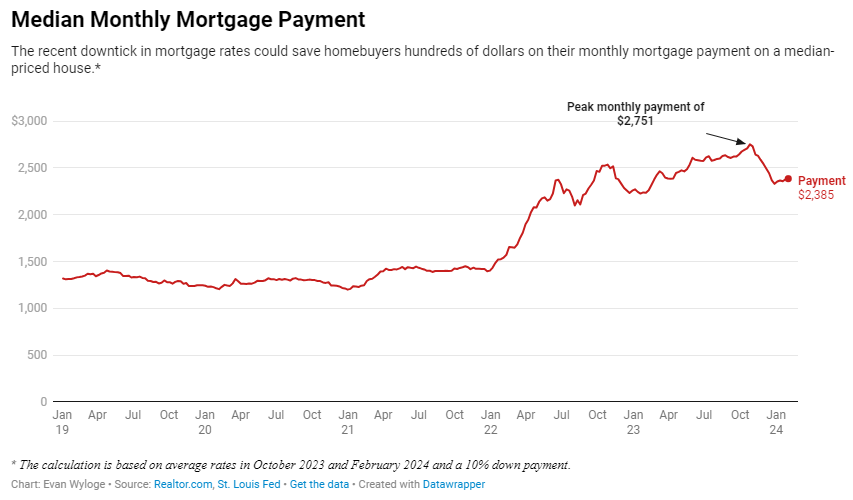

All eyes have been glued of late to the ups and downs of mortgage rates, and for good reason: In late October, they hit highs not seen in 23 years. This, in turn, pushed the cost of buying a home beyond reach for many Americans.

But what goes up has come down: Mortgage rates averaged about 6.63% for 30-year fixed-rate loans for the week ending Feb. 1, according to Freddie Mac data. That’s more than a full percentage point lower than the most recent peak* of around 7.8% just over three months earlier.

For potential homebuyers, lower mortgage rates mean that the cost of buying a house could likely be lower, too.

So how much, exactly, would homebuyers save today?

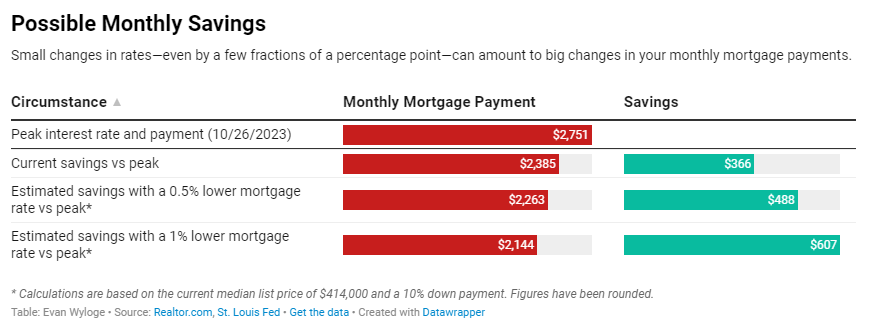

Quite a bit, it turns out: about $366 every month.

To calculate these savings, we applied the Feb. 1 average rate of 6.63% on a 30-year fixed-rate loan on a median-priced U.S. home of $414,000. The price was based on Realtor.com® national median list prices for early February. Presuming a 10% down payment, this pans out to a monthly mortgage payment of $2,385. (This doesn’t include property taxes, insurance, homeowners association dues, or other fees.)

We then compared this number with what the typical homebuyer paid when mortgage rates were higher in the last week of October, at around 7.8%. Presuming the same 10% down payment on a median-priced home of $424,990 back then, this required a monthly payment of $2,751.

To tie it all together: $2,751 – $2,385 = $366.

And this is what a typical house would cost before property taxes and mortgage insurance. (The latter is usually required if the down payment is below 20%.) Add those into the mix, and the monthly savings that homebuyers enjoy today versus just over three months ago inch up to $382.

This adds up to $4,584 a year and a whopping $137,520 over the life of a 30-year loan.

It's astonishing what a difference seemingly incremental changes in interest rates can make.

"The good news is that as mortgage rates drift lower, that can have a big impact on affordability," says Realtor.com senior economic analyst Hannah Jones.

Granted, part of this monthly cost difference is due to seasonal price fluctuations: February home prices are normally a couple of percentage points lower than in the fall. (These seasonal patterns can also help homebuyers time their purchase to maximize affordability.) Yet while home shoppers often focus on home prices, the mortgage rate they're getting could have a more significant impact on their pocketbook.

"Buyers are going to feel the impact of mortgage rates more acutely, simply because of how loans work," Jones explains. "Home prices would have to shift a lot more to impact your monthly payment in the same amount that a mortgage rate change does."

How much more will homebuyers save if mortgage rates drop further?

The numbers make clear that the trajectory of mortgage rates—from their height in fall 2023 to a slight easing in recent weeks—offers new opportunities for homebuyers. And although rates have been in a holding pattern for the past two months, the U.S. Federal Reserve is indicating that interest rates could come down further this year.

This begs another question: If rates do drop further, how much more could homebuyers save down the road?

Hypothetical scenarios can offer some perspective on the matter.

If mortgage rates were to dip by an additional 0.5%, to 6.1%, the monthly payment on a median-priced home would fall to $2,263. At a 1% rate dip, to 5.6%, it falls to $2,144. This would amount to savings of $607 every month compared with last October, when mortgage rates were much higher.

That greater affordability would probably be enough to spark more interest from potential buyers who have been waiting out the recent cycle of higher mortgage rates.

"Even if home prices don't change much, if we see mortgage rates come down, then it's likely that buyers will start to return to the market," says Jones.

The bottom line: Rates can help to determine how much you'll pay for a home over the long run.

It's also important to keep in mind that interest rates may vary from lender to lender. Homebuyers are advised to shop around for a mortgage to secure the best rate and terms for their situation.

Yorumlar